Nickel28.biz 2025

July 27, 2025

Important message from Nickel28.biz Owner/Publisher: I apologize for not publishing since July 13, 2025. I was stricken with severe back pain.

The pain is debilitating an I am unable to work. After many visits to orthopedic group, X-rays and MRI my diagnosis is: I have one vertebrae pressing on a nerve in my lumbar spine area, and as result of falling from excruciating pain I fractured a vertebrae in thoracic area of my spine. I am scheduled for a spine procedure by orthopedic surgeon on July 30, 2025.

Enough medical talk; I will recover and Nickel28.biz will be better than ever.

Until I am able to work at my old pace, I am placing Nickel28.biz on hold and not accepting new subscribers.

When I return, I will accelerate transformation of Nickel28.biz from human intelligence to our AI model “ZENITH”.

Nickel28.biz digitalization to ZENITH will replace me for creating reports, however I approve before being published.

I am truly sorry for any inconvenience, John A Hunsaker.

Nickel28.biz is known for unbiased, relevant, accurate ‘Advantageous Information‘. Fifty-seven years knowledge from experience enables subscribers to stay on top of ‘3Ni Markets’ news, information and Demand vs Supply fundamentals.

Nickel28.biz human driven algorithm gleans ‘Advantageous Information’ from global sources that relate to ‘3Ni Markets’.

*** In 2025 we are proceeding with conversion of ‘human driven algorithm‘ to ‘machine learning algorithm’ creating: Nickel28.biz: AI Program ZENITH

New for 2025– Nickel28.biz will publish Weekly Report early Sunday AM U.S. Eastern Time Zone.

Weekly Report: aggregates nickel news/information over course of the week. Nickel28.biz divides nickel into 3 markets: EV battery nickel/austenitic stainless steel nickel/LME nickel.

Publisher’s Weekly Outlook/opinion has been transformed into Ad Hoc reports.

Ad Hoc section provides prompt coverage of any major events impacting nickel markets that simply cannot wait for Weekly Report. Subscribers receive email notification of Ad Hoc reports shortly after published on Nickel28.biz website.

Ad hoc reports include: red flag alerts; caused by breaking news impacting LME nickel price/LME nickel price irregularities/nickel market incongruities….

2025 is publisher’s 57th year in nickel business. Forty-eight years trading (five years in China) nickel and high-performance nickel alloys/titanium alloys and eight years publishing Nickel28.biz. Ni knowledge is attributed to experience.

* Our Philosophy

Knowing why the price is the price provides reasoning and guidance. Our goal is to inform; we do not predict prices. Nickel market is influenced by: 1) Fundamentals: we believe demand relative to supply ultimately determines price and relevant demand vs supply information is essential.

2) Human emotion: humans are not entirely rational beings; caused by fear and greed.

(Herd instinct may cause short-term disruptions)

3) Technical data: we do not utilize technical analysis in our price direction model. Frequently technical indicators are self-fulfilling prophecies. Using the past to predict the future does not work for our purpose.

4) Nickel28.biz: proponent of ‘inefficient nickel market‘.

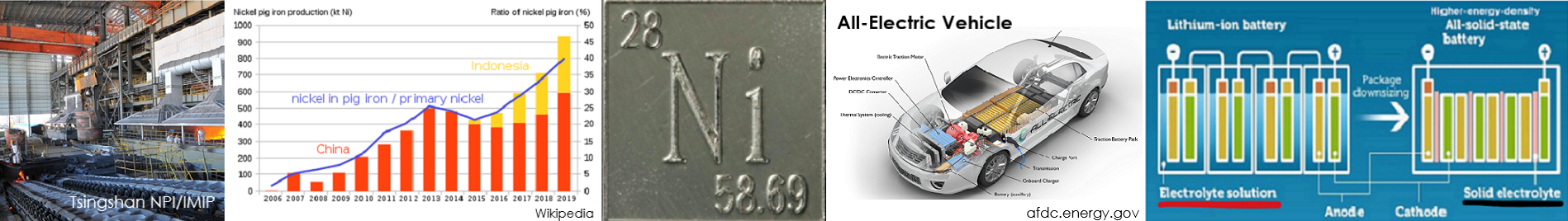

History highlights: 2023- Indonesia: Tsingshan’s nickel matte is produced in lower carbon footprint OSBS furnaces for smelting laterite nickel ore. OSBS furnaces beneficiate saprolite nickel ore into ~75% nickel nickel matte, matte is converted into nickel sulfate (NiSO4) by solvent-extraction.

Nov 1, 2020– Nickel shortages were alleged: no actual shortages occurred: Price peaks in chart were caused by erroneous nickel shortages that did not happen. **Please click menu-icon: About Publisher & The Basics- click The Basics (in free area)–

Nickel28.biz subscribers have full access to Ad Hoc reports and proprietary ‘Price Direction Model‘ reports: 365 days for $365 USD.