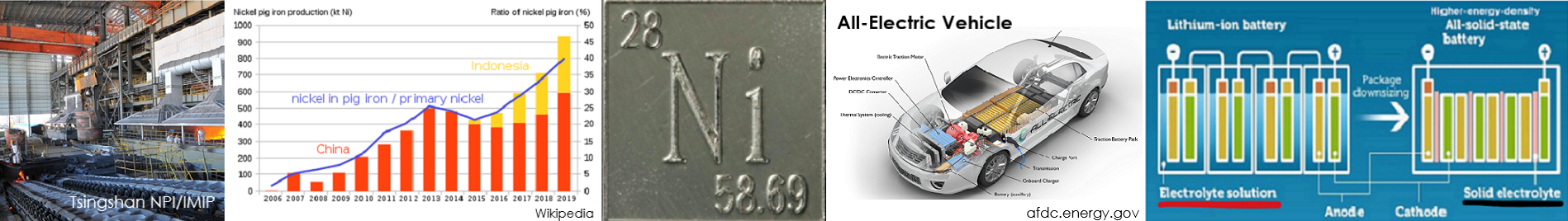

Class l & Class ll 2015 (INSG)

World primary Ni usage (demand) 1,890,000 tons

World primary Ni production (supply) 1,983,000 tons

Surplus 93,000 tons

Approximately 55% of mining output was made into Class l/refined nickel or 1,090,650 tons

- Electrolytic Ni

- Pellets

- Briquettes

- Granules

- Rondelles

- Powder/Flakes

Approximately 45% mined Ni is made into Class ll or 892,350 tons

- Ferronickel

- Nickel pig iron (NPI)

- Utility Ni

- Nickel oxide sinter

First use of Nickel – source: Nickel INSTITUTE

- Austenitic stainless steel 66%

- Nonferrous alloys 10%

- Plating 9%

- Alloy Steel 8%

- Foundry 3%

- Others 4%

First problem is 1,090,650 tons class l was produced and demand was 316,289 tons, an excess of 774,361 tons. INSG lists class 1 demand as 34% of total; we revised to 29% because not all “others” use Class 1 nickel. Our calculation is 5% of others use Class ll nickel. We believe excess exists because a disproportionate amount of class 1 is produced without contractual agreements. Producers that did not book long term contracts know they they can unload to ‘outlets’. Outlets are LME warehouses, ShFE (Shanghai Futures Exchange) warehouses, SRB inventory (China’s State Reserve Bureau; same as U.S. DLA/DNSC). Don’t forget mysterious shadow banking inventories of unknown quantity, it is invisible and can surprise the market at any time. LME stocks >360,000 metric tons and going down slowly, and other reports state there is 80,000 tons nickel shortage.

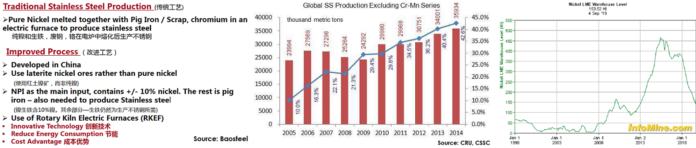

Global austenitic stainless steel production 2015 was reported to be 34.6 million tons. China produced 17.6 million tons according to USGS and 18.63 million tons according to SMI and ROW is approximately 16.5 million tons. Recent INSG melt shop data: 300 series 53.2% & 200 series 21% of total. SMI is 50% 300 series & 31% 200 series. For this example we used an average 18.115 million tons produced at 5.375% nickel for China: 8.115 million tons at 5.375% nickel equals consumption of 973,681 tons nickel. ROW 16.5 million tons at 5.5% nickel (ROW melts to higher Ni content) equaling 907,500 tons nickel. Total 34.615 million tons at 5.43% nickel average equals 1,879,595 tons nickel required. “The devil is in the details”, what is breakdown of nickel units consumed and where did nickel units come from?

China predominately consumes NPI and some ferronickel. ROW uses SST scrap plus ferronickel and minor amount of class 1 cathodes. Hypothetically: China’s 18.115 million tons SST at 5.375% nickel equals 973,681 tons nickel, deduct 15% home scrap: 2,717,250 tons at avg 5.375% nickel equals 146,052 tons. In theory China’s purchased nickel required to produce 18.115 million SST is 827,689 tons. Using NPI and ferronickel from class 2 production of 892,350 leaves class 2 Ni balance of 64,661 tons.

ROW 16.5 million tons at estimated Ni 5.5% equals 907,500 tons nickel required: using 15% home scrap equaling 2,475,000 tons at average Ni 5.5% equals 136,125 tons nickel contained in home scrap. total nickel 907,500 minus 136,125 tons nickel equals 771,375 tons purchased nickel in 18-8 SST scrap and ferronickel required.

China and ROW total purchased nickel units required to produce 34,615,000 million tons is 1,599,064 tons nickel. There was only 892,350 tons of class 2 nickel produced. Subtract China’s 827,689 requred and balance of class 2 is 64,661 tons.

ROW 16,500,000 tons SST produced: 771,375 purchased nickel units required. If we use 60% 18-8 scrap for 14,025,000 tons, it would be 8,415,000 tons at 8% nickel equaling 673,200 tons nickel. Required 771,375 tons minus 673,200 tons is deficit of 98,175 tons. Net balance from chinese requirement is 64,661 tons and net net is deficit is 33,514 tons. Mills would use a little less 18-8 scrap and ~7% ferronickel to achieve final chemistry. Essentially class 2 equilibrium.

What we want to emphasize: of annual class 1 nickel produced it only has commitments for 29%. Class 1 nickel is overproduced because it has LME as an outlet. Put into perspective there is approximately 1.14 year nickel supply in LME inventory and Class 2 is in equilibrium. In actual practice, class 2 is less expensive for making austenitic stainless steel steel and preferred by melt shops. We believe excessive emphasis on class 1 electrolytic/99.8% Ni is old school and needs to be revisited. Class 2 consumes the preponderance of global nickel supply and class 1 nickel is, “the tail wagging the dog”.