An important feature of a commodity is that its price is determined as a function of its market as a whole – by the interaction of market demand and market supply. Commodities are widely traded on specialist commodity markets. … That is how price is determined – by the interaction of demand and supply. -Jim Riley May 1, 2009-

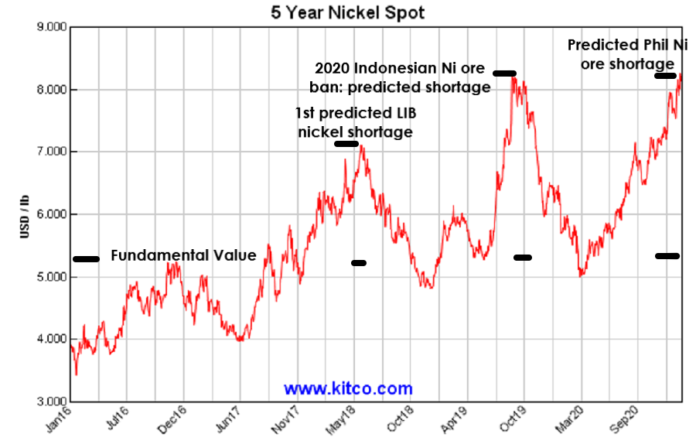

Nickel28.biz: We used $12,000 MT as fundamental value for 99.8 percent electrolytic nickel. $12,000 MT is not exact and can be argued to be more or less depending on which expert you ask. We are using $12k to make our point. When LME nickel price and fundamental nickel value diverge, it invites an obvious question: which should I trust? People who buy nickel for companies that manufacture nickel content products, lead times leave them twisting in the wind unless they hedge. Hedging mitigates price decline during lead times, however, its an expense. As differential increases between LME nickel price and fundamental value its creates dilemma.

What causes LME nickel to diverge from fundamental value? Top chart three price peaks were caused by predicted nickel shortages.

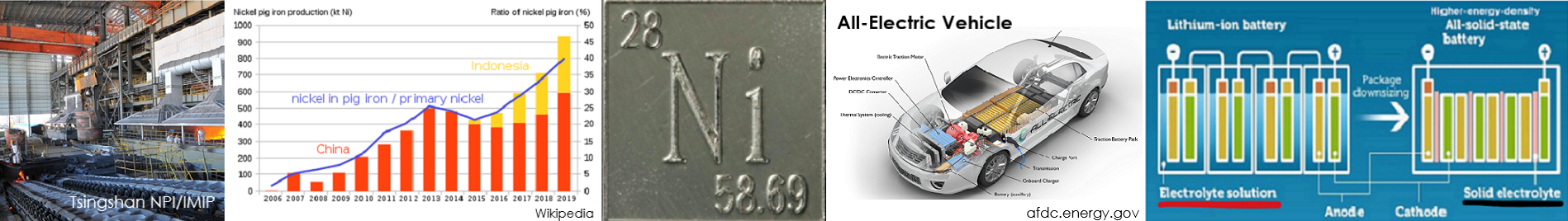

First predicted shortage was created by EV fever during 2017 LME Week. The buzz was, electric vehicles are ‘the next big thing’ and lithium-ion batteries power EVs. People quickly realized nickel is an energy source for LIBs. Pundits predicted very large numbers of EVs would be sold and nickel speculation ensued. After predicted tens of millions EV sales, economists started doing the math for how much nickel, cobalt and lithium would be required and the rest is history (LIB Ni price spike on headline chart). The upshot is, three years later and still no actual EV-LIB nickel shortage, however market influencers continue to promote and hype LIB nickel shortage.

Second predicted shortage caused by Indonesia accelerating scheduled 2022 nickel ore export ban and brought it forward to January 1, 2020.

Original 2014 nickel ore export ban was for all unprocessed nickel ore. In 2016 Indonesia had a large budget deficit and missed revenues by $17.6 billion. [(Reuters ‘Nickel miners must now dedicate at least 30 percent of their smelter capacity to processing low-grade ore, defined as below 1.7 percent nickel’. ◊ Where, considering installed (smelter) capacity, the ore production they can’t absorb will be allowed to be sold overseas,” Coal and Minerals Director General Bambang Gatot told reporters.] https://www.reuters.com/article/us-indonesia-mining-exports-idUSKBN14W1TZ

The untold reason Indonesian government required smelters to use at least 30% of <1.7% nickel ore: <1.7% Ni content ore is ‘limonite’-laterite ore. It was a waste/no value/landfill material because in the early days of nickel ore exports to China, Chinese NPI producers only wanted >1.7% ‘saprolite’-laterite nickel ore. >1.7% Ni ore could be converted to ~13% Ni NPI for 304 stainless steel, limonite Ni content was to low for 304 SST. Indonesia’s President Widodo said to landfill <1.7% Ni ore was waste of a resource and it must be used.

Nickel28.biz: The reality of 2020 nickel ore ban: Indonesian govenment officials realized ‘low grade’/<1.7% aka limonite-laterite nickel ore could be made into Li-ion battery cathodes and also contained recoverable/payable cobalt. Please read following from Jakarta Globe.

Jakarta Globe August 27, 2019: “Nickel Ore Export Ban Is Good for Indonesia: Vale”

“Bernandus Irmanto, the president director of Vale Indonesia, however, said Indonesia may be better off by imposing the ban sooner than later, especially considering its ambition to make electric car batteries from nickel ores.”

“The best limonite ores for electric car batteries are grade 1.4 and below. If the government allows exports for grade 1.7 and below, then we are exporting the best materials for the batteries. Most countries are buying the main materials for batteries from us, and the receiving countries, such as China, mostly just pile them up,” Irmanto said on Tuesday.

In addition, the ore export ban would keep the price of nickel in the global market high. Nickel price has been rising by 30 percent since June.

“Indonesia is a big player in the global nickel market. We contribute 27 percent of all the nickel products in the market. We stand to profit a lot from a higher price for nickel,” Irmanto said. https://jakartaglobe.id/context/nickel-ore-export-ban-is-good-for-indonesia-vale

Bottom line: Indonesian nickel ore ban 2020 was not about China running out of ore to make NPI for 300 series stainless steel. Limonite <1.7% nickel ore is not used in making high grade NPI. The price spike that peaked on October 24, 2019 at $16,950 MT/$7.69 lb, was hyped and promoted by nickel market influencers. There has not been a shortage of nickel ore. Actually, there is concern of Indonesian NPI oversupply weakening nickel price.

Third predicted nickel shortage is work in progress, in our opinion, it is about to end, without actual shortage. Third predicted shortage is about Philippine nickel ore to make ~8% 300 series stainless steel. Philippine nickel ore is predominately ‘low grade’/limonite <1.7% nickel. [Chinese NPI smelters blended Philippine nickel ore with supply of high-nickel (saprolite) Indonesian ore stockpiled before 2014 ore ban went into effect. They stretched ore supply and did not run out of ore.] For 2020, Mainland China has a better option, they imported Indonesian NPI made with Chinese owned nickel ore/smelters. Indonesian NPI is lower cost than Mainland NPI (no mainland air-pollution). Why would they resort to using low nickel Philippine ore and waste cobalt content that can be used for LIB cathodes?

We believe China is transitioning all mainland NPI production to Indonesia and Philippines ore will be used to make MHP for LIB cathodes. Philippine nickel ore shortage for NPI is a masquerade, that increased the price of nickel ~$3,500 above nickel’s fundamental value.

Two things that support our masquerade thesis: A- Philippines has two HPAL plants that produce mixed Ni-Co hydroxide precipitate (MHP): MHP is a precursor for LIB cathodes. Coral Bay, commissioned in 2005 and Taganito, commissioned in 2013 are HPAL plants that use limonite nickel ore (both plants are owned by Sumitomo Metal Mining Company. B- Philippines does not have one NPI smelter because there is very little saprolite ore left in Philippines.

For nickel speculators, hyping nickel shortage spikes price second only to declaration of force majeure. Hyped nickel shortages has been overused and abused. When Nickel28.biz can validate an actual nickel shortage or anything legitimate that will cause nickel price to go up or down, our subscribers will be the first to know.

Thank you,

Nickel28.biz