Nickel Pioneer Shut Out as China Cuts Back Smokestacks

Bloomberg News

In just eight years, burning mineral-laden dirt to make nickel pig iron has gone from a prized business that revolutionized the steel industry to a target in China’s self-declared war on pollution.

Liu Guanghuo was at the center of it all. The junior-high school dropout amassed a fortune and built one of China’s 100 most profitable private companies with a processing technique that yielded a cheaper alternative to pure nickel. Smelters across the country copied him, boosting supplies and undercutting global prices.

Today, Liu says his furnaces are idle, the local government wants tourists rather than smokestacks and banks won’t fund him. The chances of his Zhejiang Huaguang Smelting Group Co. making a comeback took an additional hit on Jan. 12, when Indonesia banned shipments of low-grade ores he used to create NPI.

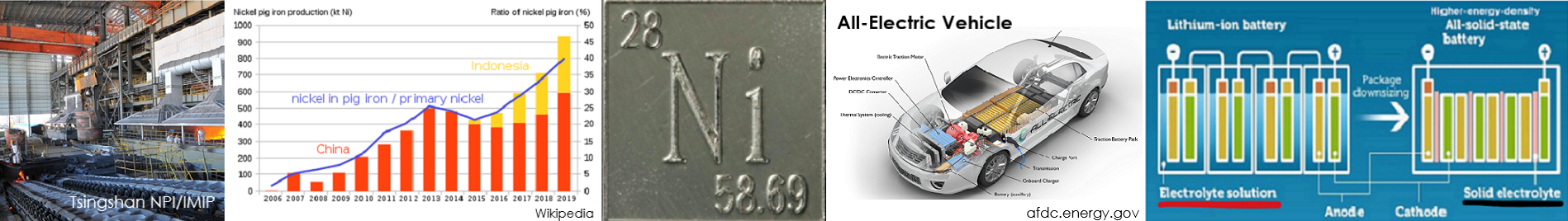

He says more metals companies will share his fate as Communist Party leaders in Beijing pledge to curb pollution. China’s output of NPI, estimated by Macquarie Group Ltd. to account for 25 percent of global nickel supply, may stall this year after increasing 34 percent in 2013, according to Liu.

“Liu Guanghuo was the trailblazer,” said Xu Aidong, an analyst at Beijing Antaike Information Development Co. Tougher emissions standards and volatility in global nickel prices hurt the pioneer, said Xu, who has studied the metals industry for two decades.

New Path

“The factories in my hometown are unlikely to restart with the district promoting itself as the most beautiful county in China,” Liu, 68, said as he chain-smoked during an interview at his four-story villa in Tonglu, a three-hour drive southwest of Shanghai. “Pollution’s a big concern for the nation, and heavy industries like smelting come up when people talk about haze.”

Tonglu County shut down hundreds of manufacturers from printers to metals plants in recent years as it promoted itself as a travel destination, said Xu Limin, who runs the district’s tourism authority.

“These factories were owned by locals and contributed to our local economy,” said Xu. “Now we have to shut them because we’ve shifted to more environmentally friendly development.”

Shoveling nickel-rich soil into furnaces to make NPI also creates piles of slag containing heavy metals, pumps carbon monoxide and microscopic traces of nickel, iron and coke into the atmosphere and consumes electricity, in a nation that burns coal to generate about 66 percent of its power.

The concentration of PM2.5, fine airborne particles that pose the greatest risk to human health, stuck at hazardous levels for a week in Beijing last year.

Hazardous Smog

Chinese Premier Li Keqiang said earlier this month that pollution is a major concern, pledging the government will “declare war” on smog and close coal-fired furnaces.

The country will reduce emissions of PM2.5 and impose a ceiling on energy consumption, Li said on March 5 at the start of this year’s National People’s Congress.

Liu, a father of four, got into the metals business long before China’s leaders cracked down on pollution. He said his interest was piqued in the late 1960s when he was surrounded by steel as a gunner aboard a naval frigate in the East China Sea.

One day in 1984, Liu was riding his bicycle home in Tonglu when he noticed the road was sparkling with waste from ferro-chrome production, he said.

“I’d always thought of things that glitter as valuable,” said Liu, who pored over metallurgical books in his spare time. As entrepreneurs embraced Deng Xiaoping’s moves toward a market economy, Liu said he quit his job at a state electricity bureau to start re-smelting material cast out from government mills.

Finding Riches

“There were piles of stuff that had been lying around so long that trees and grass was growing on them,” said Liu, who estimated his current wealth to be about 400 million yuan ($65 million), mostly in property and industrial projects. This figure couldn’t be independently verified.

His first success in producing nickel pig iron was in 1997, smelting discarded laterite ores from Albania in a 40-year-old blast furnace built in the neighboring county of Fuyang during Mao Zedong’s Great Leap Forward era, he said.

Another breakthrough came as he perfected temperature control inside the furnace and reduced the amount of fluorite used as a flux to smelt ore, said Liu. It allowed him to turn ore containing as little as 1.5 percent of the metal into NPI with as much as 8 percent nickel content, he said.

Antaike’s Xu said Liu built the foundation for the industry to go on to produce material with as much as 12 percent purity. Antaike is a research unit of the state-backed China Nonferrous Metals Industry Association.

Pure Nickel

While stainless steel made from NPI is used to make cutlery, kitchen sinks and washing machines, higher grade alloys with industrial and military applications typically require pure nickel feedstock.

Others who failed before him had used too much fluorite, said Liu, whose formal education extended one year beyond elementary school.

His output reached 3,500 metric tons using newer and bigger furnaces in 2000, the same year benchmark nickel futures on the London Metal Exchange averaged about $8,460 a ton. By 2006, when LME prices had almost tripled, Liu said he started selling his alternative to the Chinese operations of Posco, South Korea’s biggest steelmaker. He also secured supply of raw materials from Indonesia and the Philippines.

As pure nickel surged to a record $51,800 in May 2007, demand took off in China as steel mills sought to reduce costs by using more NPI. Metal use in China accelerated as the country’s economy grew 11.2 percent that year.

Surging Output

Rivals adopted his methods, according to Liu and Antaike’s Xu. Almost all NPI production is in China and reached about 480,000 tons last year, according to estimates from Antaike.

“Competition in the industry has been cut-throat and brutal,” said Henry Liu, a Hong Kong-based executive director at China Merchants Capital who has tracked NPI since 2006. “Specialists were poached from leaders in the sector as factories sought to constantly improve their techniques.”

Henry Liu is no relation to Liu Guanghuo.

Rising supplies of NPI helped erode demand for nickel, and prices have declined for three straight years. The metal has rebounded this year, after Indonesia imposed its ore-export ban in a bid to promote domestic processing.

Price Gauges

Nickel settled at $15,450 a ton in London on March 10, up 11 percent since the end of December, the most of six industrial metals on the LME. The Standard & Poor’s GSCI Spot Index of 24 commodities gained 2.3 percent, while the MSCI All-Country World Index of equities added 0.3 percent. The Bloomberg U.S. Treasury Bond Index increased 1.4 percent. Nickel traded at $15,509 today.

Liu’s early success contributed to his present woes, according to Antaike’s Xu. His businesses were China’s biggest buyer of laterite ores from Indonesia in 2007, which rose in price as nickel peaked on the LME, said Xu. The metal then slumped from its high, leaving his plants with expensive raw materials and allowing new entrants to buy in at lower prices.

Antaike estimates that NPI production costs in China have dropped in half to $11,000 a ton over the last five years, with the advent of more efficient processes using rotary kiln electric furnaces. The smelters should remain profitable as long as China’s ore inventories hold up.

Stockpiles accumulated before the Indonesia ban were large enough to feed mills through June, according to the average of nine projections compiled by Bloomberg News in January from smelters, miners, traders and analysts based in China.

Indonesian Ban

The prospect of immediate job losses for miners in an election year may prompt the government in Jakarta to ease the export restrictions. Stephen Briggs, a senior metals strategist at BNP Paribas SA, and Andrew Shaw, head of base metals research at Credit Suisse Group AG, have said there may be changes.

The Ministry of Energy and Mineral Resources said last month that Indonesia had no plans to change its position.

Liu is no longer reaping the benefits of his innovation after suspending operations last year. Nor are some NPI plants from Inner Mongolia province, which were shut down by the government last year to curb pollution, said Zhu Renguo, a Shanghai-based purchasing manager with Jiangsu Baotong Nickel Industry Co.

China is also squeezing steel, aluminum and cement makers, seeking to cut pollution by reducing overcapacity and shutting old and obsolete factories.

“We started getting less and less funding from the banks,” said Liu. “The government gradually tightened policies on industries with high emissions and power consumption.”

He hasn’t given up on making a comeback and surprising the metal market one more time. Liu said he’s tinkering with a process that uses raw coal rather than coke to smelt NPI, cutting production costs by as much as 20 percent.

“I won’t let the secret out easily this time on how I’m making it,” he said.

— With assistance by Alfred Cang